Rising Wood Pellet Exports: Vietnam's Growing Role in Global Markets

In contrast to the prevailing gloomy outlook for the wood industry, experts reveal a surge in wood pellet exports due to favorable global factors. During the first half of 2023, wood pellet exports are estimated at a staggering 1.85 million tons, resulting in a projected turnover of nearly $300 million USD. Vietnam's primary customers for wood pellets are Korea and Japan.

Vietnam: The World's Second-Largest Wood Pellet Exporter:

According to the Vietnam Wood and Forest Products Association (VIFOREST), Vietnam has claimed the position of the world's second-largest wood pellet producer, trailing only behind the United States. Over 95% of Vietnam's wood pellet production is exported to Korea and Japan, primarily for power generation. A small portion is utilized domestically for boilers and kilns. Over the past decade (2013-2022), Vietnam's pellet export volume and value have shown remarkable growth, increasing by 28 and 34 times, respectively.

Recent Export Statistics:

In 2022, Vietnam exported a substantial 4.9 million tons of wood pellets, generating a turnover of $0.79 billion USD, demonstrating the industry's robust performance. During the first half of 2023, wood pellet exports are estimated at 1.85 million tons, with a projected turnover of nearly $300 million USD. Vietnam is the primary supplier of wood pellets to Korea, accounting for 80% of their total demand. However, early 2023 witnessed significant price fluctuations for Vietnamese wood pellets, with prices dropping to a low of $78 USD/ton in April but gradually rebounding to approximately $110 USD/ton by July.

Factors Driving Rising Prices:

Vietforest's analysis attributes the increasing import prices of Vietnamese wood pellets in South Korea to rising input material costs within Vietnam. Unlike the Japanese market, which primarily sources wood pellets from domestically planted forests with FSC certificates, Korean wood pellet production relies heavily on by-products from the woodworking industry, such as sawdust and shavings. Concentrated in the Southeast provinces, these wood processing enterprises have seen a sharp drop in by-product supply, intensifying competition among manufacturers and driving up pellet material prices. It is anticipated that by the end of 2023, Vietnam's export volume to Korea will reach approximately 1-1.5 million tons.

Changing Procurement Strategies: Korean businesses have adapted to market volatility by shifting from bulk bidding to smaller, more frequent shipments, reducing price pressure and inventory costs.

Stability in the Japanese Market: In contrast to the Korean market's volatility, the Japanese market offers stability, characterized by long-term orders spanning 10-15 years and prices ranging from $145 to $165 USD/ton (FOB Vietnam). Additionally, short-term contracts are secured at lower prices, currently around $125/ton (FOB), while maintaining product quality.

Japan's Growing Demand: Vietnamese wood pellet exports to Japan reached 0.87 million tons, generating $151 million USD in the first five months of 2023. Although export volume decreased by 5.7%, turnover increased by 19.7% compared to the same period in 2022. Projections suggest that Japan's demand for wood pellets will surge in the future, driven by a shift towards cleaner energy. By 2030, it is expected that Japan will require 13-15 million tons of wood pellets, presenting a substantial opportunity for Vietnamese businesses with stable input materials, sustainable certifications, large-scale production facilities, and systematic management.

Future Growth Prospects:

Experts emphasize that the wood pellet export industry is on the upswing, buoyed by favorable global market conditions. The worldwide demand for wood pellets is expected to grow by approximately 250% over the next decade, reaching 36 million tons from 14 million tons in 2017. While European countries, Japan, and Korea have been the main drivers of this growth, Vietnam's pellet industry is poised to capitalize on domestic demand as the government actively promotes renewable energy sources, including biomass power, to replace high-emission coal power. This bodes well for the rapid expansion of the domestic wood pellet market in the coming years.

* Có Thể Quý Khách Quan Tâm

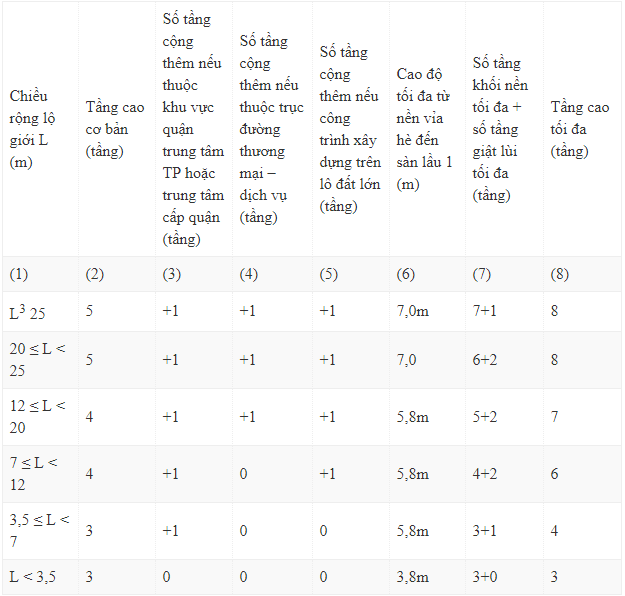

QUY ĐỊNH VỀ SỐ TẦNG ĐƯỢC PHÉP XÂY DỰNG TẠI TP HCM

QUY ĐỊNH VỀ SỐ TẦNG ĐƯỢC PHÉP XÂY DỰNG TẠI TP HCM

WOOUP COMPANY LIMITED IN WOOD PELLET INDUSTRY

WOOUP COMPANY LIMITED IN WOOD PELLET INDUSTRY

Q&A Wooup Co.,Ltd - Wood pellet supplier in Vietnam

Q&A Wooup Co.,Ltd - Wood pellet supplier in Vietnam

Why Choose WOOUP CO., LTD in the Wood Pellets Industry?

Why Choose WOOUP CO., LTD in the Wood Pellets Industry?

8 THINGS YOU NEED TO PAY ATTENTION TO WHILE IMPORTING GOODS FROM VIETNAM

8 THINGS YOU NEED TO PAY ATTENTION TO WHILE IMPORTING GOODS FROM VIETNAM